Risk Management Enterprise - An Overview

Table of ContentsThe 8-Second Trick For Risk Management EnterpriseAll About Risk Management EnterpriseRisk Management Enterprise for BeginnersThe smart Trick of Risk Management Enterprise That Nobody is Talking AboutWhat Does Risk Management Enterprise Mean?Getting My Risk Management Enterprise To Work6 Easy Facts About Risk Management Enterprise Shown

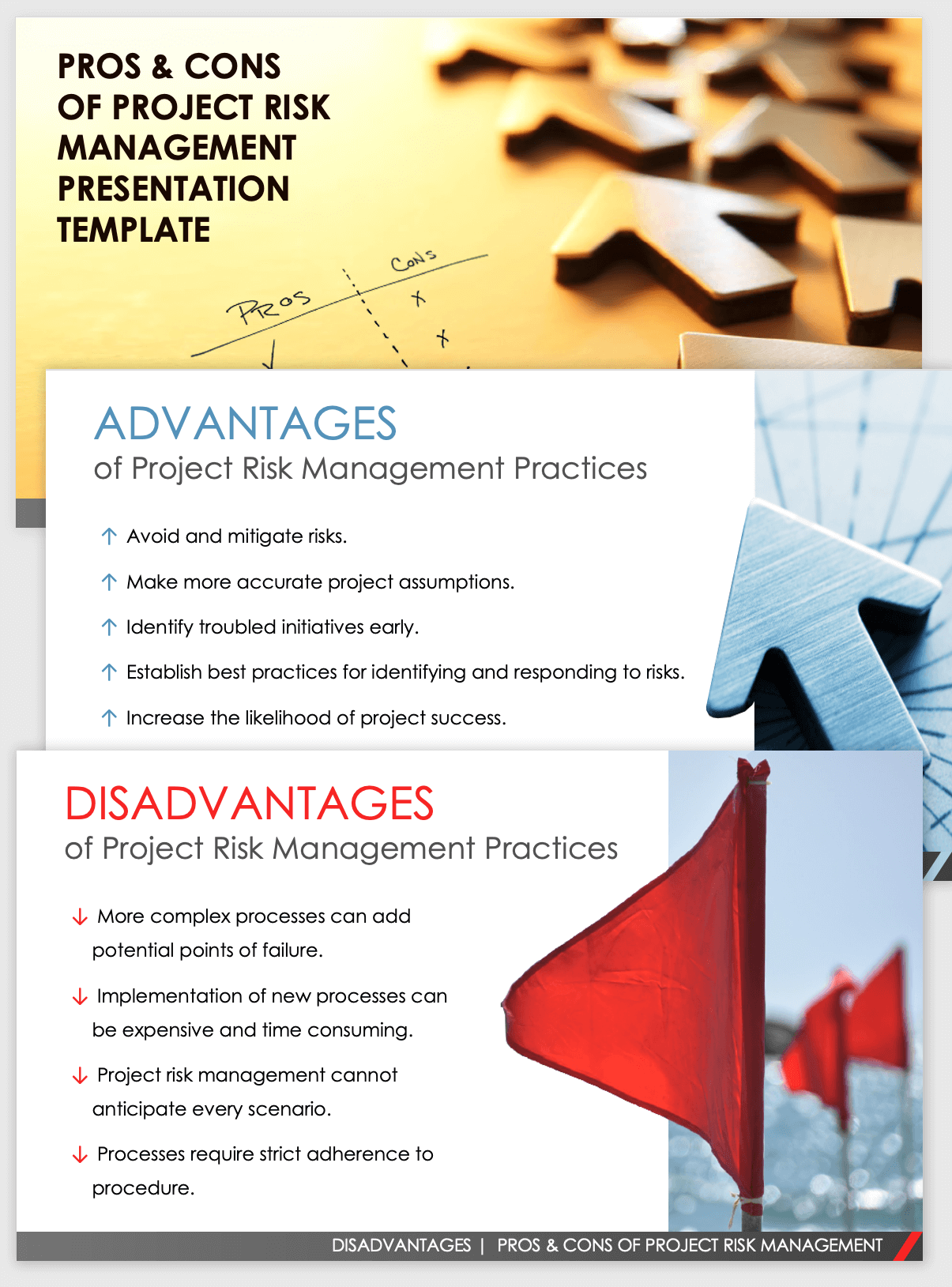

By leveraging an aggressive expectation and very carefully considering various situations, you're able to have a much better understanding on prospective risks that your business can deal with. When you have an understanding and clear expectation, you can make a decision how to continue to straighten actions with service goals. In doing so, you create and foster a society that is not scared of threats, along with one that operates with both dexterity and durability.With a solid risk management approach, you're displaying your level of treatment and intent to stakeholders, which breeds confidence - Risk Management Enterprise. By recognizing threats, leaders and monitoring teams can effectively allocate resources to finest handle future outcomes. This includes funds, along with just how to assign duties to various individuals within your group in order to finest execute and handle the selected strategy of activity

More About Risk Management Enterprise

With automation software program, you can relax guaranteed that you'll have all your business's data neatly centralized and ready-to-use for analysis or reference. While the ins and outs of every organization's danger management plan will certainly differ, there are best methods beneficial to consider and follow to efficiently exercise risk monitoring. Bear in mind these suggestions: Keep the company's goals at the leading edge of every choice Be organized Leverage information and information for decision-making Include everyone in your company that is involved Display continually and make adjustments as needed Create worth for the company Utilize technology and automation software application wherever possible There may be other events and situations that creep up that obstacle your risk administration plans to drop apart.

A tiny mistake can cause major damage, particularly in very managed sectors such as finance. And, even if all people are in area and trained, errors happen that can be as a result of bad governance. Risk Management Enterprise. That's why it is very important to have dependable software application, basic methods, and oversight in location to safeguard your company versus mishaps and mistakes

Throughout, hyperlinks link to other articles that supply even more in-depth details on the topics covered right here. Risk management is important to service success-- probably more so now than ever before. The threats that contemporary organizations face have actually grown more intricate, sustained by the fast pace of globalization. Brand-new risks continuously arise, commonly pertaining to the now-pervasive use of technology.

The Greatest Guide To Risk Management Enterprise

Several organizations are still grappling with a few of the dangers postured by the COVID-19 pandemic. That includes the continuous requirement to handle remote or hybrid workplace and what can be done to make supply chains less susceptible to disturbances. Consequently, a danger monitoring program need to be intertwined with business approach.

Right here's a primer on risk exposure in a company and just how it's calculated. Many specialists keep in mind that taking care of risk is an official feature at business that are greatly managed and have a risk-based business version.

The Facts About Risk Management Enterprise Revealed

For other industries, danger often tends to be more qualitative. That enhances the demand for a purposeful, detailed and regular approach to risk administration, stated Gartner method vice president Matt Shinkman, who leads the consulting company's threat management and audit practices.

Screen the outcomes of threat controls and readjust as essential. These are the key steps to take to identify, evaluate and handle threats. These actions audio uncomplicated, however danger administration committees set up to lead efforts should not take too lightly the job needed to complete the process - Risk Management Enterprise. For starters, a solid understanding of what makes the organization tick is needed.

They additionally document risk response strategies, risk owners and stakeholders, and the expense of handling threats. Companies can get these advantages by using a threat register as part of their danger monitoring programs.

Approach and objective-setting. Efficiency. Evaluation and alteration. Info, interaction and coverage. ISO 31000. Launched in 2009 and modified in 2018, the ISO standard consists of a list of ERM concepts, a structure to help organizations use danger administration systems to procedures, and the process outlined over for determining, assessing and reducing dangers.

The smart Trick of Risk Management Enterprise That Nobody is Talking About

The more recent variation additionally stresses the vital duty of senior monitoring in threat programs and the assimilation of danger management techniques throughout the company. Some nationwide requirements bodies and groups have actually likewise Learn More released country-specific versions of ISO 31000. The American National Criteria Institute provides a version that's looked after by the American Society of Safety Professionals.

Threat averse is an additional characteristic of organizations with standard threat management programs. For lots of companies, "danger is an unclean four-letter word-- and that's unfortunate," Valente stated.

Standard danger management additionally has a tendency to review be responsive. In enterprise danger monitoring, handling threat is a collaborative, cross-functional and big-picture initiative. An ERM group debriefs business system leaders and team about risks in their locations and helps them believe via the threats. The group after that collects details concerning all the risks and presents it to senior executives and the board.

Not known Details About Risk Management Enterprise

The former operate at firms that see danger administration as an insurance plan, according to Forrester. Transformational CROs focus on their firm's brand track record, comprehend the horizontal nature of danger and sight ERM as a method to enable the "correct amount of risk required to grow," as Valente put it.

Much more self-confidence in business objectives and goals since threat is factored right into technique. An affordable benefit over business competitors with much less mature risk administration programs.

ISO 31000's total seven-step process is a beneficial guide to adhere to for creating a strategy and after that implementing an ERM framework, according to Witte. Right here's a much more comprehensive review of its elements: Interaction and appointment. Raising danger recognition is an important More hints part of danger administration. The communication plan developed by risk leaders should efficiently share the company's danger policies and treatments to staff members and various other appropriate celebrations.

Some Known Facts About Risk Management Enterprise.

Developing the scope and context. This step requires defining both the company's risk hunger and risk resistance. The last term refers to just how much the threats connected with specific efforts can differ from the general risk hunger. Variables to take into consideration here consist of organization objectives, business society, regulative demands and the political setting, to name a few.